Discretionary Managed Account Services

Brief description of business:

HONGKONG YUANMING FUND MANAGEMENT CO., LIMITED has extensive qualifications and experience in two-way and cross-border asset management services, provides tailored discretionary managed account services to different types of domestic and foreign investors through comprehensive and in-depth understanding of investors' needs for liquidity and investment returns, as well as risk appetite. As investment manager, we utilize our expertise in professional asset management, research and product design and global multi-asset allocation to provide more tailored and personalized services to our clients.

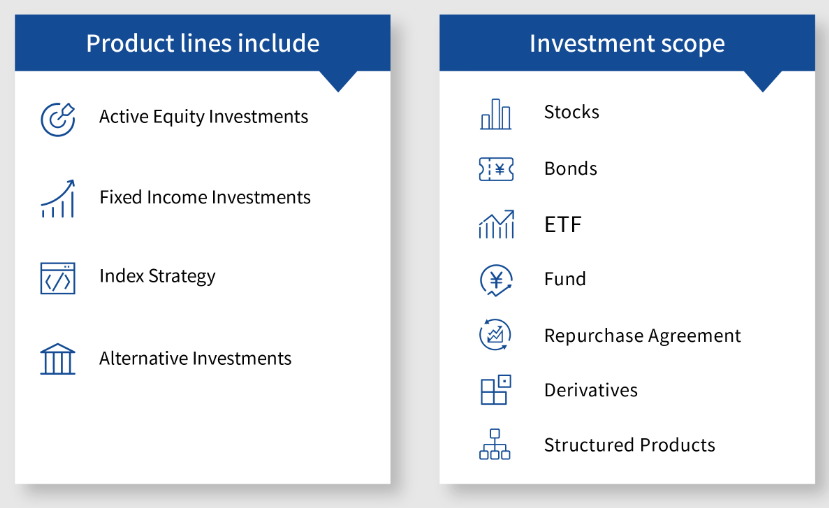

Discretionary Managed Accounts allow for more flexibility and investment strategies can be adjusted in accordance with investments requirements. The discretionary managed account services managed by HONGKONG YUANMING FUND MANAGEMENT CO., LIMITED include mandate for RMB Qualified Foreign Institutional Investors (RQFII) and Qualified Foreign Institutional Investor (QFII), mandate for offshore investment products. At present, we mainly provide the services to sizable Chinese institutional clients, especially financial institutions, China-affiliated corporations with off-shore subsidiaries, as well as high-net-worth individuals. While satisfying regulatory requirements, HONGKONG YUANMING FUND MANAGEMENT CO., LIMITED will seize market opportunities and investors' demand, and utilize regional advantages to actively initiate innovation in investment scope, domicile, investment strategies, product structure and client service, so as to provide clients with quality products and long-term steady returns.

Discretionary Managed Account Services

Regular Information Disclosure

Daily net value of portfolios

A list of daily valuated positions held

Monthly, semi-annual and annual reports

Customized Reports

Investment management information disclosure reports

Policy interpretation

Preparation of regular invest-ment management information disclosure reports (monthly report)

Meeting With Fund Managers

Once every quarter, face-to-face or by telephone meeting

Exchange views on market reviews of the previous quarter, market outlook analysis

Exchange views on quarterly performance data on portfolios, etc

Other Services

Special or Ad-hoc sessions

Will be held as and when required